Blog

COP28 Recap

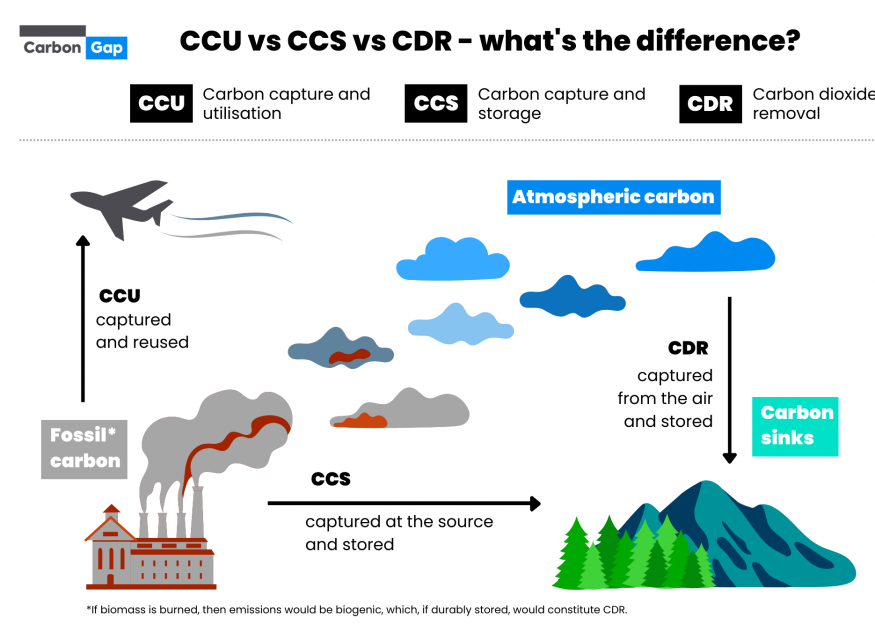

Carbon Dioxide Removal and Global Stocktake Agreement

Each year world leaders gather at the Conference of Parties (COP) to negotiate and discuss global climate commitments and the biggest questions surrounding the climate crisis. The conference is convened annually by the members of the U.N. with two goals: (1) to review the implementation of the conference, the Paris Agreement, and the Kyoto Protocol, and (2) to adopt decisions to further these instruments.

Dr. Christina Clamp Selected for the Cooperative Hall of Fame

Honoring Excellence in Community Well-Being Leadership

Dr. Christina Clamp, ASBN co-coordinator of our Catalyzing Community Well Being Initiative and co-editor of “Humanity@Work&Life”, was just selected for induction into the U.S. Cooperative Hall of Fame (https://en.wikipedia.org/wiki/Cooperative_Hall_of_Fame) – the highest honor bestowed by the U.S.

Are You Prepared?

California Climate Corporate Data Accountability Act Signed Into Law

We are excited to share that California’s Climate Corporate Data Accountability Act has just been signed into law and is now the most comprehensive carbon emissions reporting requirement in the United States!

ASBN strongly supports California’s efforts and has highlighted the benefits of carbon emissions reporting and transparency in our Carbon Labeling Business Case.

The American Sustainable Business Network Applauds President Biden’s Formation of the American Climate Corps

The American Sustainable Business Network (ASBN) is thrilled to announce our enthusiastic support for President Biden’s recent announcement of the American Climate Corps (ACC).

The Inflation Reduction Act: One Year Later

The Inflation Reduction Act (IRA) is a crucial player in driving emission reductions and enforcing action to combat climate change, and has the potential to get us closer to the United States’ goals to cut emissions in half by 2030.

American Businesses Support the EPA’s Carbon Pollution Standards

On June 14th, 2023 the Environmental Protection Agency (EPA) held a virtual public hearing on the proposed rule to cut climate pollution from fossil fuel-fired power plants. American Sustainable Business Network’s (ASBN) Director of Climate and Energy Policy, Michael Green testified on behalf of ASBN to provide a business perspective supporting this regulation. If passed, this proposed rule would cut carbon pollution nearly 617 million metric tons through 2042.

Carbon Labels Are Good For Business

Carbon is the leading source of human-induced climate change. It contributes to air pollution, ocean acidification, global temperature fluctuations and on and on.

Reading the Air:

Cutting Emissions on Power Plants is Needed Now

Closed schools, communities are being told to shelter in place and masks are back out. But this time, it is not for COVID, it is for a very different public health crisis: air pollution. At the forefront of everyone’s minds are the wildfires devastating Canada and sending toxic fumes down and across the United States.

Effectively Engaging Media

Learn how to advance your organization’s message and objectives through the media. This webinar is designed for business, organized labor, nonprofits, and advocacy groups.

This webinar is co-presented by the American Sustainable Business Network, the Ohio Sustainable Business Council, and Ohio University Voinovich School of Leadership and Public Service.

Presenters:

– Katie Ellman, Communications Coordinator, American Sustainable Business Network

Shifting the Mindset from Despair to Determination on Climate Change

The American Sustainable Business Network’s Livable Planet Working Group presents, “Shifting the Mindset from Despair to Determination on Climate Change.”

Anthropocentric climate change is an ecological and social punch to the gut, and no longer a thing of the future. Catastrophic events unfolding around feel overwhelming and too big to act on, but it is imperative that we face them head on, and not get distracted by multiplying stimuli.

The Emissions Gap

In December 2022, the UN released its annual emissions gap report outlining the most up-to-date estimate of the difference between where greenhouse emissions are predicted to be in 2030 and where they need to be to avert the worst impacts of climate change. This year’s report reflected advances in climate modeling and data on land use, land use change, and forestry emissions harmonizing historic differences between data and projected scenarios.

Building Regenerative Agriculture Supply Chains in the 2023 Farm Bill ft. VT Sen Welch

In an increasingly uncertain economy, disrupted by severe and erratic climate conditions and global supply chain instability, regenerative agriculture represents a clear path forward for American businesses. Yet, these businesses have experienced barriers to fully bringing regenerative agriculture into their U.S. supply chains. In addition to the low number of agricultural producers trained in soil health practices, there are national supply chain gaps in the form of missing aggregators; limited processing and manufacturing capacity; and the associated shortages of skilled labor.

IRA Implementation in the Electric Vehicle Battery Industry and the Clean Energy Transition

IRA Implementation in the Electric Vehicle Battery Industry and the Clean Energy Transition

Restorative Capital Innovators- Investing in Inclusive Economies

The Restorative Capital Innovators series will focus on the work of BIPOC fund managers successfully building models of restorative finance. The April webinar is the first in a series and it also launches the partnership between Inclusive Capital Collective and the American Sustainable Business Network to unlock more capital resources to BIPOC fund managers within the ICC network.

Why Hydrogen and Why Now?

The American Sustainable Business Network, Ohio University and the Ohio Sustainable Business Council co-present ‘Why Hydrogen and Why Now?’. Learn about hydrogen projects moving Ohio and the U.S. toward a more sustainable energy and manufacturing economy.

Featured Speakers:

– Nick Connell, Interim Executive Director, Green Hydrogen Coalition

– Wiley Rhodes, CEO, Newpoint Gas

– Frank Calzonetti, Vice President of Research, The University of Toledo

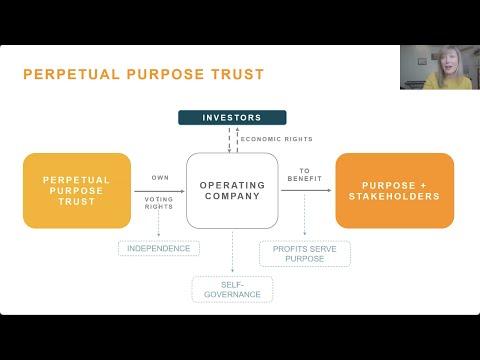

How to Align Ownership Interests with your Business’s Mission

American Sustainable Business Network presents ‘How to Align Ownership Interests with your Business’s Mission’, an interactive webinar with RSF Social Finance CEO Jasper van Brakel and Natalie Reitman-White, ownership & governance design advisor at Alternative Ownership Advisors.

Cultivating Change: Accelerating the Shift to Purpose-Driven Business

The American Sustainable Business Network has always led from the front, showcasing values-based leadership, social ventures, corporate social responsibility, and the ‘triple bottom line.’ Today, as ‘purpose’ goes mainstream, we have a profound opportunity to reshape the way the world does business.

Address the Growing Climate Crisis by Supporting Methane Regulations

On November 11, 2022, the Biden Harris Administration announced a proposal through the EPA to strengthen and expand Methane regulations. The American Sustainable Business Network (ASBN) supports these efforts, and has released our own Business Case for Methane Emissions Regulation.

Clean Energy & Infrastructure: Impact & Opportunities

The American Sustainable Business Network and experts discuss how funding opportunities in the Bipartisan Infrastructure Bill and the Inflation Reduction Act will dramatically change the energy landscape. The nearly $369 billion in climate and clean energy provisions in the new law include grants and tax credits that will bring down emissions and provide businesses with the certainty they need to make long-term investments in clean energy.

Speakers: